Overview Development and origin of patent applications

Although the number of patent applications declined in 2021, compared to 2020, by 5.7% to 58,568, the newly filed applications were still at a high level, highlighting the importance of Germany as a location for innovation.

As in the previous year, the economic effects of the coronavirus pandemic probably play a crucial role in the ongoing decline in application numbers. Resurgent infection rates and multiple lockdowns made it difficult for many companies and institutions to push ahead with the technical development and the preparation of patent applications as usual.

The major part of the 58,568 patent applications registered last year, that is 51,668, were filed directly with our office. 6,900 applications entered the national phase as PCT applications filed in accordance with the Patent Cooperation Treaty (PCT) through the World Intellectual Property Organization (WIPO) in Geneva.

The option of filing patent applications electronically is still very popular with our customers, as can be seen from a further increase by 1.6 percentage points in online applications to 88.5% of all patent applications filed.

At the end of 2021, 134,715 national patents were in force, i.e. 1.8% more than in the previous year.

The German Patent and Trade Mark Office (DPMA) substantially improved its performance over the past year and concluded more patent procedures than at any time in more than 30 years. The office concluded 48,489 procedures in total, 16.1% more than in the previous year.

The number of patent grants in particular reached a record level: In 2021, the examining sections of the DPMA issued positive decisions for 21,113 inventions — an increase of 22.0% compared to the previous year. In this way, the DPMA significantly contributes to the competitiveness of enterprises, makes them more attractive to investors and facilitates more advantageous cooperation ventures. The proportion of procedures completed by the grant of a patent (grant rate) also rose to 43.5% (2020: 41.5%). In 10,322 cases (2020: 8,454), the application was refused – this corresponds to a proportion of 21.3% of completed procedures (2020: 20.3%). 17,054 of the examination procedures were terminated because the applicant withdrew the application or failed to pay the fees, which accounts for 35.2% of the concluded procedures. The high number of concluded procedures meant that the DPMA was able to reduce its backlog of pending examination procedures for the first time in many years.

In 2021, there was a slight decrease by 5.8% in applications received from applicants having their domicile or principal place of business in Germany. These applicants filed 39,812 applications in total. This means that the percentage of applications from Germany remained stable at 68% compared to the previous year. The number of patent applications from abroad again slightly dropped to 18,756 (2020: 19,841).

Last year, 3,366 applications came from European countries (2020: 3,228) and 15,390 from non-European countries (2020: 16,613).

There was an increase of 50% in applications from Singapore. The number of applications from China (13.8%) and from Canada (45%) also increased. By contrast, applications from Japan (-8.9%) continued to decrease. The applications from the United States stayed almost flat (+0.2%).

| Countries of origin | Applications | Percentage |

|---|---|---|

| Germany | 39,812 | 68.0 |

| Japan | 6,128 | 10.5 |

| USA | 5,892 | 10.1 |

| Republic of Korea | 1,558 | 2.7 |

| Switzerland | 866 | 1.5 |

| Austria | 782 | 1.3 |

| Taiwan | 753 | 1.3 |

| China | 568 | 1.0 |

| France | 396 | 0.7 |

| Sweden | 320 | 0.5 |

| Others | 1,493 | 2.5 |

| Total | 58,568 | 100 |

The patent applications from Germany can be allocated to individual German Länder according to the residence or the principal place of business of the applicant. The German Länder ranking is again led by Baden-Württemberg with 13,570 applications (-0.8%), followed by Bavaria with 11,875 applications, which comes again second in the ranking (-6.5%). From North Rhine-Westphalia, which came third, 5,675 applications were received (-11.2%). Lower Saxony came in fourth place with 2,982 applications (-7.8%). The remaining German Länder all recorded a slight decline compared to the previous year’s figure.

If we compare the filing figures to the respective numbers of inhabitants, Baden-Württemberg and Bavaria were again in the lead with 122 applications and 90 applications respectively per 100,000 population. Lower Saxony again came in third (37).

If the cursor is moved over the chart, it shows the patent applications in 2021 and the applications per 100,000 inhabitants as well as the change in percent per German Länder (residence or principal place of business of the applicant).

With 3,966 applications, Robert Bosch GmbH again led the ranking of the most active patent applicants in 2021. Bayerische Motoren Werke AG came second with 1,860 applications in 2021, thus relegating Schaeffler Technologies AG & Co.KG to third place with 1,806 applications.

Daimler AG and ZF Friedrichshafen AG shared 4th place with 1,315 registrations each. The sixth place went to VOLKSWAGEN AG (1,243 applications), thus relegating Ford Global Technologies, LLC (997 applications), which had taken sixth place in the previous year, to seventh place and AUDI AG (747 applications) to eighth place.

The individual companies and institutions are shown in the form in which they appear as patent applicants — possible intra-group affiliations are not taken into consideration.

Last year, 4.5% of our applicants filed more than ten applications each (2020: 4.2%). This means that 69% of all applications were filed by this group of applicants, referred to as large patent applicants.

In the case of applications from commercial enterprises, a distinction is made between the company filing the application and the inventor as a natural person. However, in the case of employees with released inventions or independent inventors, the applicant and the inventor are usually identical. In 2021, the applicant and the inventor were identical in 5.7% of the applications (2020: 5.9%).

The International Patent Classification (IPC) is used worldwide as a standard for classifying technological contents. A number-and-letter code organises the entire field of technology in more than 70,000 units. At the DPMA, every patent application is attributed to one or several IPC classes according to its technical content and forwarded to the examining section in charge at our office.

In 2021 too, the technology field “Transport” ranks first among the top technology fields in terms of filing activity with 10,482 applications, which means, however, a slight decline by 2.8% compared to the figure for the previous year. A large proportion of applications came from the automotive industry.

With 7,168 applications (+2.0%), the technology field “Electrical machinery and apparatus, energy” again ranked second, followed by “Measurement”, which now comes in third, with 4,490 applications (-2.0%).

In 2021, we saw a substantial decline in the number of applications in the technology field “Medical technology” (-17.0%) and in the technology field “Other consumer goods” (-26.0%). In the field “Medical technology”, this concerns, among others, subclasses for disinfection and sterilisation technology and in the field “Other consumer goods”, it concerns protective clothing and face masks. Applications in these areas had skyrocketed in the first coronavirus crisis year of 2020. This trend did not continue in 2021. Compared to the number of applications in 2019, the number of applications in the field of medical technology fell by 8.7%.

(According to WIPO IPC concordance table, available at: www.wipo.int/ipstats/en/index.html#resources.)

The decline in application numbers due to the pandemic did not further continue for filed requests for the examination of patentability pursuant to section 44 of the Patent Act (Patentgesetz). 43,155 examination requests mean that their level is stable.

By conducting a comprehensive and thorough search, the patent examiners identify the relevant state of the art during the examination procedure. The state of the art identified will be taken into consideration to examine whether the subject matter of the application is new and involves an inventive step. It is also examined whether the subject matter of the application is industrially applicable and whether exclusions from patentability possibly exist. Further criteria, for example sufficient disclosure must be met. Then, the examining section can decide whether and to what extent a patent can be granted or whether the application must be refused.

The number of search requests pursuant to section 43 of the Patent Act increased by 4.8% to 14,920 in 2021. Search requests are used to assess patentability in order to file international applications, if promising. The conclusion to be drawn from both key figures is that the demand for patents is not diminishing. However, in 2021, 7.8% fewer isolated searches under section 43 of the Patent Act were concluded and 15,174 search reports were sent out.

| patent procedures | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Examination requests received | 47,450 | 47,133 | 47,344 | 43,337 | 43,155 |

| - including requests filed together with applications | 26,540 | 26,201 | 26,000 | 23,383 | 22,671 |

| Search requests pursuant to section 43 Patent Act | 15,603 | 15,679 | 15,843 | 14,243 | 14,920 |

| Concluded searches pursuant to section 43 Patent Act | 14,571 | 14,240 | 14,943 | 16,451 | 15,174 |

| Examination procedures concluded (final) | 36,850 | 38,110 | 40,185 | 41,753 | 48,489 |

| Examination procedures not yet concluded in the patent divisions at the end of the year | 211,759 | 220,500 | 227,274 | 228,450 | 222,697 |

If a party files an appeal against a decision — a patent granted not as requested or a refusal or a decision in opposition proceedings – the Technical Boards of Appeal of the Federal Patent Court will then decide on the further course of action. Compared to the previous year, we again saw a marked decline in appeal proceedings brought before the Technical Boards of Appeal: A total of 123 appeal proceedings were received (-44.1%). The number of concluded appeal proceedings also fell by 21.4% to 312 in 2021. At the end of 2021, 367 appeal proceedings were still pending at the Federal Patent Court.

In Focus Selected fields of technology

Digitisation

The positive trend in the number of patent applications from the field of digitisation, which has been ongoing for ten years, also continued in 2021 (+4.3%). For the analysis we took into account the applications published by the DPMA and the European Patent Office (EPO) with effect in Germany. Patent applications are published after 18 months. Therefore, the analysis can only show to some extent the effects of the coronavirus pandemic in Germany from March 2020 onwards.

Published applications again increased by 4.6% compared to the previous year in the five selected sub-sectors of digital technologies — audio-visual technology, digital communication, computer technology, IT methods for management and semiconductors. The application figures from China in particular increased significantly (+15.1%). The group of applicants still include small and medium-sized enterprises, but also large companies operating at an international level.

The sector computer technology ranked first in 2021. With a steep increase (+6.3%) to 15,492 applications it has surpassed the sector of digital communication. Applications in this area focus on systems for image data processing, speech recognition or information and communication technology. Developments that use artificial intelligence or involve machine learning are playing a big role in this field.

| Country | 2020 | 2021 | Change compared |

|---|---|---|---|

| USA | 5,655 | 5,943 | +5.1 % |

| China | 1,513 | 2,017 | +33.3 % |

| Germany | 1,600 | 1,814 | +13.4 % |

| Japan | 1,577 | 1,574 | -0.2 % |

| Republic of Korea | 1,055 | 1,059 | +0.4 % |

| Others | 3,169 | 3,085 | -2.7 % |

| Total4 | 14,569 | 15,492 | +6.3 % |

1 Applications published by the DPMA and the EPO avoiding double counts.

2 According to WIPO IPC concordance table, available here. IPC classes valid at the time of retrieval counted proportionately; without claim to completeness; results may be included that do not relate to computer technologies.

3 G06C, G06D, G06E, G06F, G06G, G06J, G06K, G06M, G06N, G06T, G06V, G10L, G11C, G16B, G16C, G16Y, G16Z.

4 Due to rounding differences, the values added together deviate from the total.

With a total of 15,132 national and international patent applications, digital communication was only the second largest of the five sub-sectors (+1.4%) in 2021 and no longer at the top like in the two previous years.

Since 2011, the number of applications has risen by more than 94%. Most applications focus on the transmission of digital information, wireless communication networks or what has become known as the Internet of Things (IoT). Furthermore, this area also covers patent applications relating to the new 5G standard in mobile communication.

Due to the contact restrictions during the coronavirus crisis, it was imperative for many companies to further expand these digital communication technologies. These include the communication of machines, control devices and sensors, to enable remote control — for example from a work station at home. In many companies, the use of such highly networked systems on an industrial scale for intelligent process and production control (“smart factory”) has become commonplace. At home too, these technologies are being used for remote-controlled coordination of air conditioning, lighting or electrical appliances (“smart home”).

| Country | 2020 | 2021 | Change compared |

|---|---|---|---|

| China | 4,032 | 4,308 | +6.8 % |

| USA | 4,218 | 4,115 | -2.4 % |

| Japan | 1,295 | 1,336 | +3.2 % |

| Sweden | 1,223 | 1,267 | +3.6 % |

| Republic of Korea | 1,249 | 1,176 | -5.8 % |

| Others | 2,904 | 2,931 | +0.9 % |

| Total4 | 14,921 | 15,132 | +1.4 % |

1 Applications published by the DPMA and the EPO avoiding double counts.

2 According to WIPO IPC concordance table, available here. IPC classes valid at the time of retrieval counted proportionately; without claim to completeness; results may be included that do not relate to digitisation.

3 H04L, H04N 21, H04W.

4 Due to rounding differences, the values added together deviate from the total.

In the year under review, the sector audio-visual technology was the third largest, with 5,671 applications (+9.3%). The pandemic-induced restrictions prompted more and more people to use audio and video systems, both professionally and privately. Audio or video conferences enable entire teams to communicate in real time without being in the same place.

The audio-visual technology field also covers applications in the area of virtual reality (VR) and what is known as augmented reality (AR). Virtual reality refers to a purely digital, computer-created image of the real world. For example, virtual reality can be used to simulate surgical procedures in order to train medical staff for real-life usage. It is also possible to make fully virtual trips or journeys easily while staying at home. The users need virtual reality glasses that allow them to immerse themselves in a completely computer-generated world.

Augmented reality, on the other hand, is the interaction of the digital and the analogue world. The users can be shown additional virtual information that is superimposed on their real-world environment via glasses or simply the camera of a smartphone. A common example is displaying virtual markers during the analysis of a football match. The scene is shown in real time and overlaid with the virtual trajectory of a ball or the distances to players of the opposing team.

| Country | 2020 | 2021 | Change compared |

|---|---|---|---|

| USA | 1,119 | 1,234 | +10.3 % |

| China | 743 | 1,055 | +42.0 % |

| Japan | 1,099 | 1,029 | -6.4 % |

| Germany | 622 | 631 | +1.4 % |

| Republic of Korea | 546 | 607 | +11.2 % |

| Others | 1,061 | 1,116 | +5.2 % |

| Total4 | 5,190 | 5,671 | +9.3 % |

1 Applications published by the DPMA and the EPO avoiding double counts.

2 According to WIPO IPC concordance table, available here. IPC classes valid at the time of retrieval counted proportionately; without claim to completeness; results may be included that do not relate to digitisation.

3 G09F, G09G, G11B, H04N 3, H04N 5, H04N 7, H04N 9, H04N 11, H04N 13, H04N 15, H04N 17, H04N 19, H04N 101, H04R, H04S, H05K.

4 Due to rounding differences, the values added together deviate from the total.

Compared to the previous year, we also saw an increase of 4.6% in the sector of semiconductors. As before, applications have primarily focussed on semiconductor components and solid state electrical components or assemblies of components. These functional components are absolutely essential for making fast-progressing digitisation possible in all fields of application.

| Country | 2020 | 2021 | Change compared |

|---|---|---|---|

| Japan | 1,053 | 1,020 | -3.1 % |

| USA | 1,063 | 884 | -16.8 % |

| Republic of Korea | 564 | 820 | +45.4 % |

| Taiwan | 470 | 695 | +47.9 % |

| Germany | 723 | 646 | -10.7 % |

| Others | 1,066 | 1,099 | +3.1 % |

| Total4 | 4,938 | 5,163 | +4.6 % |

1 Applications published by the DPMA and the EPO avoiding double counts.

2 According to WIPO IPC concordance table, available here. IPC classes valid at the time of retrieval counted proportionately; without claim to completeness; results may be included that do not relate to digitisation.

3 H01L.

4 Due to rounding differences, the values added together deviate from the total.

This was the only sub-sector that saw a slight decline (-0.3%) in the number of applications, which amounted to 2,656. Applications in this field describe IT methods, for example for business management purposes, for industrial manufacturing (4IR), autonomous delivery systems (robots and drones) and networked mobility such as autonomous driving. The networking of an increasing number of terminal devices, control systems and machines generates ever larger amounts of data (big data). Large volumes of data can be processed and stored in a decentralised way by using what is known as cloud computing. Servers, storage media, databases or analysis options are made available via the Internet for this purpose.

| Country | 2020 | 2021 | Change compared |

|---|---|---|---|

| USA | 961 | 982 | +2.2 % |

| Germany | 384 | 373 | -2.9 % |

| Japan | 324 | 358 | +10.5 % |

| China | 122 | 129 | +5.7 % |

| Republic of Korea | 102 | 103 | +1.0 % |

| Others | 769 | 711 | -7.5 % |

| Total4 | 2,663 | 2,656 | -0.3 % |

1 Applications published by the DPMA and the EPO avoiding double counts.

2 According to WIPO IPC concordance table, available here. IPC classes valid at the time of retrieval counted proportionately; without claim to completeness; results may be included that do not relate to digitisation.

3 G06Q.

4 Due to rounding differences, the values added together deviate from the total.

Innovation against climate change

German companies are leaders in the field of climate-friendly technologies in the German market. As measured by the number of patent applications effective in Germany, German companies, research institutions and independent inventors are leading the rankings of renewable energy sources and technologies that support climate-friendly mobility.

However, taken as a whole, the dynamism in innovation differs markedly between the two fields of technology: While innovation activity in e-mobility and alternative energy sources has increased significantly in recent years, the development of alternative power generation has stagnated for years and is far below the level of 2012. Last year, the number of patent applications effective in Germany published by the German Patent and Trade Mark Office (DPMA) and the European Patent Office (EPO) even decreased slightly, compared to the previous year.

Automotive technology still is a top field of technology in terms of applications in Germany. Application activity has shifted from the internal combustion engine to e-mobility in recent years.

For this analysis, we studied the applications for internal combustion engines, electric motors, batteries and fuel cells as well as what are known as electric fuels (referred to as e-fuels). This relatively new development field comprises synthetic fuels allowing engines to run in a climate-neutral manner as they are produced using electricity from renewable energy sources and carbon dioxide taken from the atmosphere.

In 2021, for the first time in several years, the number of published applications for purely electric vehicles saw a slight drop of 3.1%.

As in the previous years, the technical focus of applications is mostly on a cost-effective and space-saving arrangement of the electric drive unit. To increase driving comfort and provide more space in the car interior, use is made of smaller batteries and space-saving arrangements of batteries.

For internal combustion engines we have seen a decline in the number of applications for some years. Compared to 2020, the number again dropped by 25.6%. The development departments currently focus on designing engines that are cost-effective and operate at optimum efficiency and on removing nitric oxides from exhaust gases of diesel engines in order to further reduce climate-damaging greenhouse gas emissions.

The upward trend in the field of alternative energy sources for electric motors of recent years has continued. The number of applications in the field of batteries increased by +4.9%. Compared to the previous year, the number of applications concerning fuel cells also increased substantially by 38.0% and confirm the upward trend observed over the past few years.

Electric motors can also be powered by hydrogen. Fuel cells are needed for this purpose. The gaseous hydrogen reacts with oxygen in a chemical process producing water, releasing the energy stored in the hydrogen as electricity. This electricity powers the electric motor without producing any harmful emissions. Fuel cells are wear-resistant and low-maintenance. An advantage of hydrogen-powered vehicles is that they have a longer range than battery electric vehicles.

Renewable energy sources are geothermal energy, wind and solar energy, biomass and hydropower. They can make a substantial contribution to climate protection, thereby slowing down climate change. Either processes taking place in nature are harnessed or electricity, heat or fuel is generated from renewable raw materials.

Germany also held a leading position in the ranking of countries with the highest numbers of applications in this field. Germany took first place in solar technology, hydropower and other regenerative energy sources such as geothermal energy and biogas. However, the ranking for wind generators, which represent the field of technology with by far the most applications filed, was led by Denmark; Germany came second.

Overall, the level of applications filed in the field of renewable energy sources was markedly lower than ten years ago. The number of patent applications continued to decline (-5.6%) – as in previous years. Only the field of solar technology showed a slight upward trend (+2.2%).

Since 2016, the annual number of published applications concerning renewable energy sources has stagnated at 1,100 to 1,200. Possible reasons for this could be worse economic and political framework conditions compared to previous years.

However, various pieces of energy legislation and federal funding programmes are intended to increase the share of renewable energy in the future.

1 Applications published by the DPMA and the EPO avoiding double counts.

2 IPC classes valid at the time of retrieval counted proportionately. Without claim to completeness. Results may also include other uses.

3 C02F 1/14, E04D 13/18, F03G 6, F24J 2, F24S, G05F 1/67, H01L 31/04 to H01L 31/078, H02J 7/35, H02N 6, H02S.

4 F03D.

5 F03B 7, F03B 13/10 to F03B 13/26.

6 C12M 1/107, C12M 1/113, F03G 3, F03G 4, F03G 7/00 to F03G 7/08, F24J 3, F24T 10, F24T 50, F24V 40, F24V 50, F24V 99.

125 years ago The flying inventor

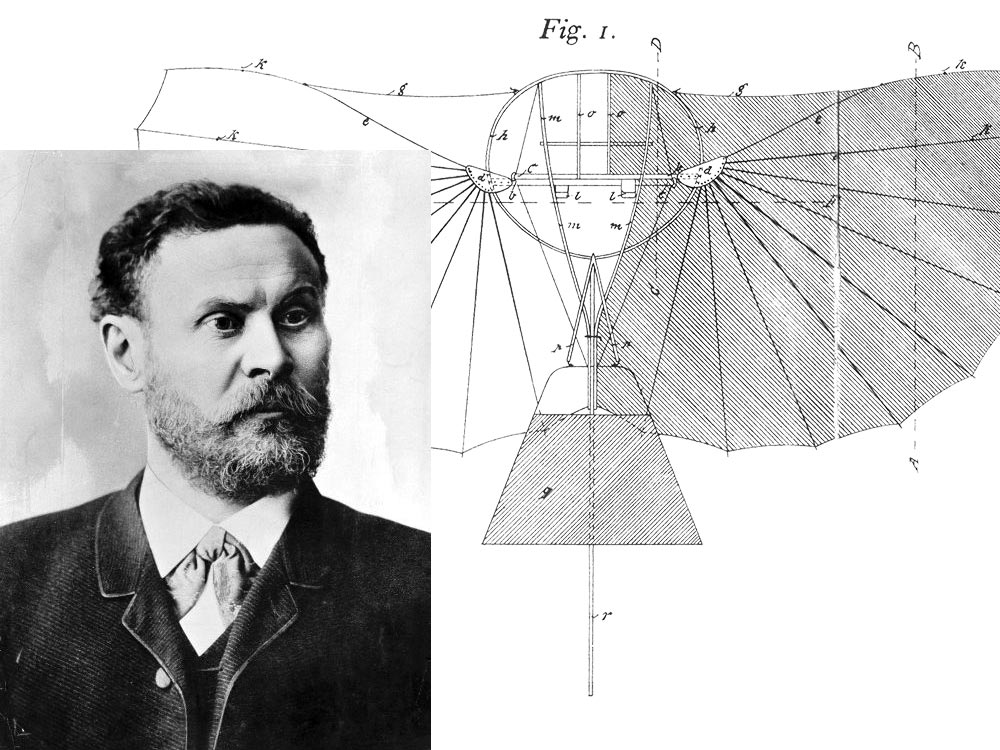

He is world-famous as the “father of aviation”: Otto Lilienthal. 125 years ago, the aviation pioneer died. However, it is less well known that Lilienthal also was a versatile inventor and engineer who, together with his brother Gustav, applied for quite a few interesting patents in the most diverse fields.

Otto Lilienthal around 1895

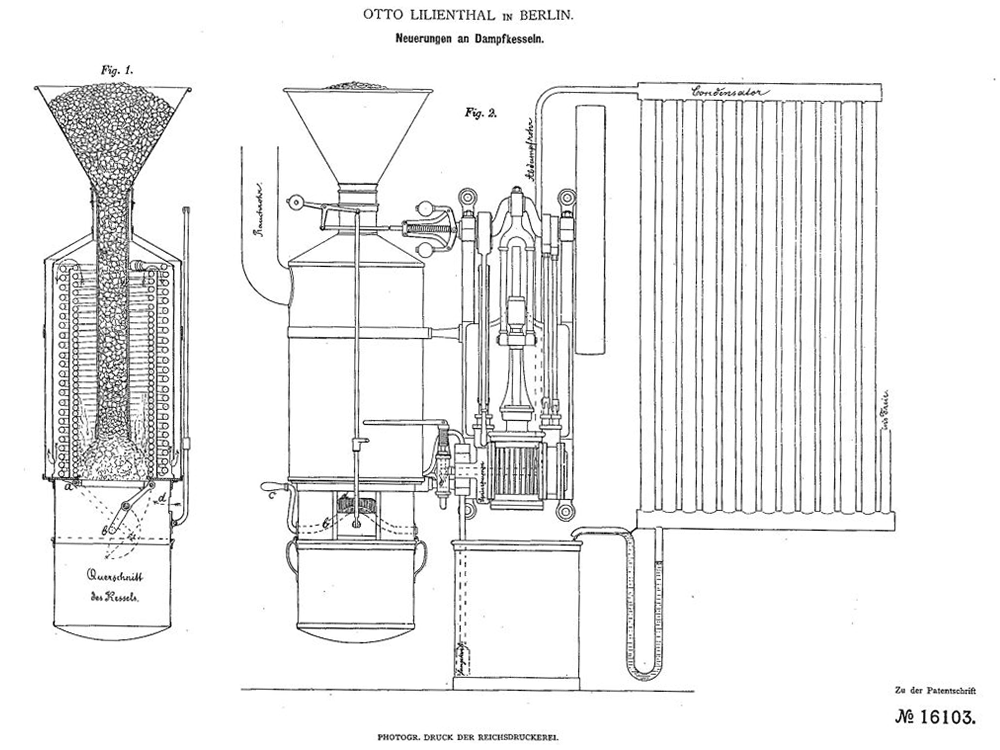

"innovations to steam boilers", DE16103

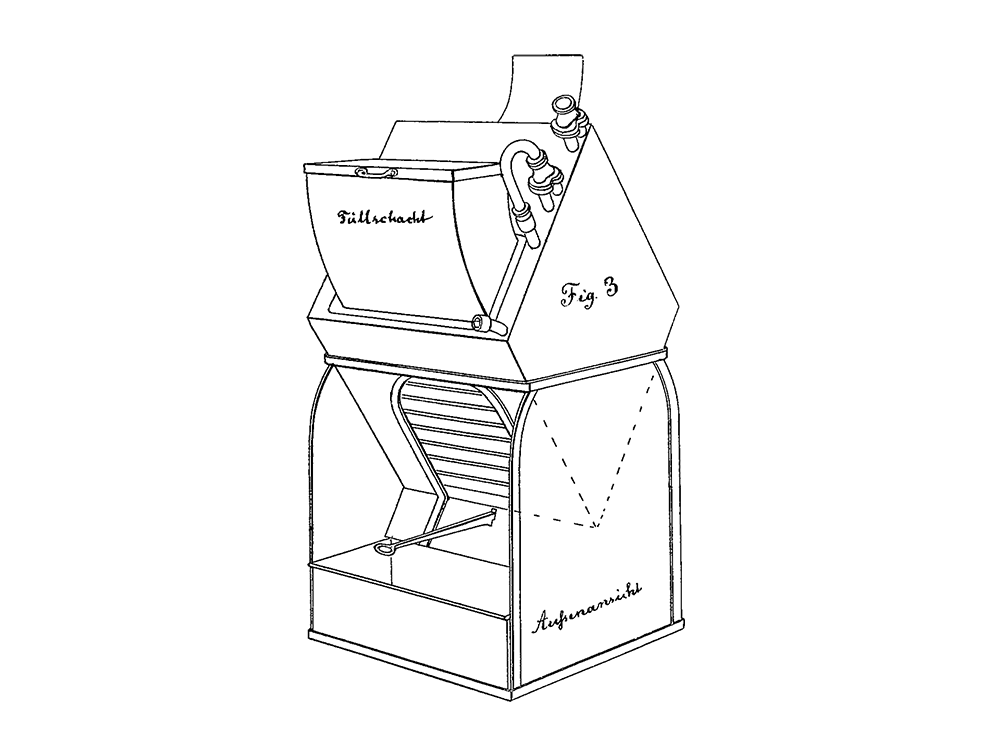

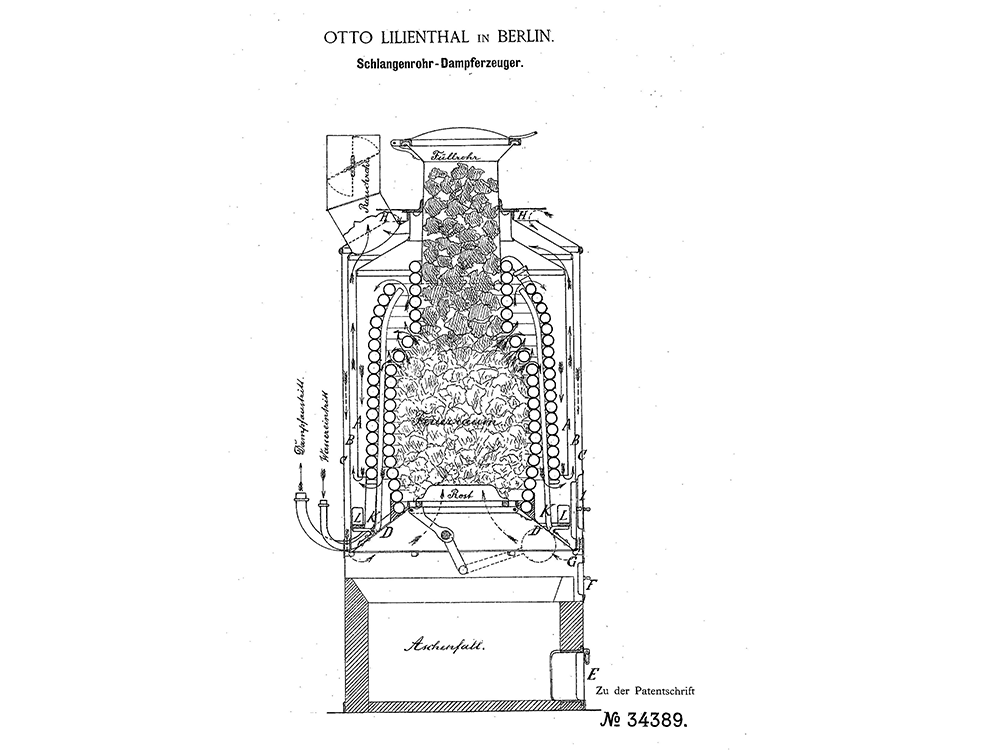

"Serpentine tube boiler" (DE29080A)

"serpentine tube steam generator", DE 34389A

DE77916A_"Flugapparat"

Flight attempt at the Mühlenberg hill in Derwitz in 1891, photographed by Carl Kassner

Gliding flight, around 1895

Otto Lilienthal 1894, photographed by Ottomar Anschütz

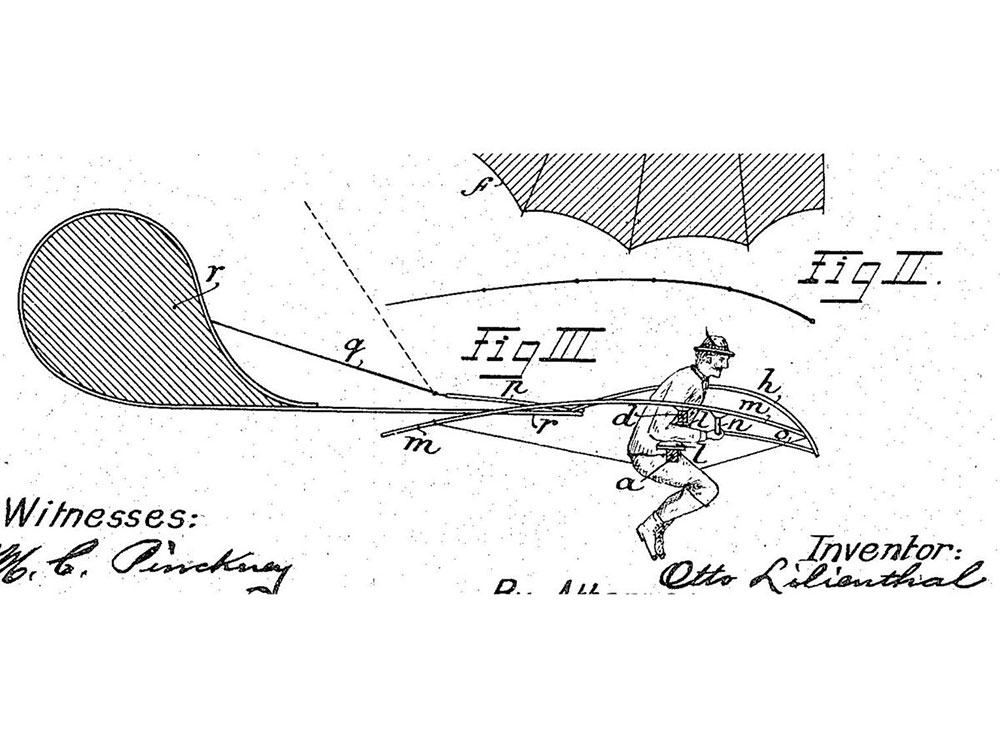

Only genuine with the feather attached to the hat: U.S. patent for Lilienthal's "flying machine" (US544816)

A current Anker stone building set

Flying was Lilienthal’s childhood dream. He was born in Anklam on 23 May 1848. From an early age, he used every spare minute to study the flight of birds. Whether at the grammar school in Anklam, as a student of mechanical engineering in Berlin, as an engineer working in a machine factory or later as an independent entrepreneur — in his spare time Lilienthal always engaged in research and experiments to discover the secret of flight.

Before his first flight experiments, Lilienthal was successful as a design engineer: Together with Gustav, he designed a “Schräm-Maschine mit Messerscheibe” (coal cutter with cutting disc) for coal mining (DE2291). He invented a siren foghorn for lighthouses, a new method for draining waste water (DE71479), a screw locking device (DE44700) and a “reading game” (DE44540A).

The two brothers also developed a modular set of toy building blocks. In 1880, they applied for a US patent (US233780), but then sold it to the entrepreneur Friedrich Adolf Richter. Richter turned the architectural toy into a global success. The stone building set is still on sale today under the name “Anker-Steinbaukasten” (DE word mark 2011940). It is the “oldest modular toy in the world” according to the manufacturer.

In the 1880s, Otto Lilienthal applied for two patents, which enhanced the safety of steam engines: “innovations to steam boilers” (DE16103A) and “serpentine tube boiler” (DE29080A). The financial success of these patents gave him scope for his interest in flight.

Lilienthal built his first gliders using willow and cotton. In June 1891, he jumped with his hang glider off the Mühlenberg hill near Krielow in Brandenburg and glided for about 15 metres – the birth of aviation. Lilienthal made sure that his flight attempts were documented photographically.

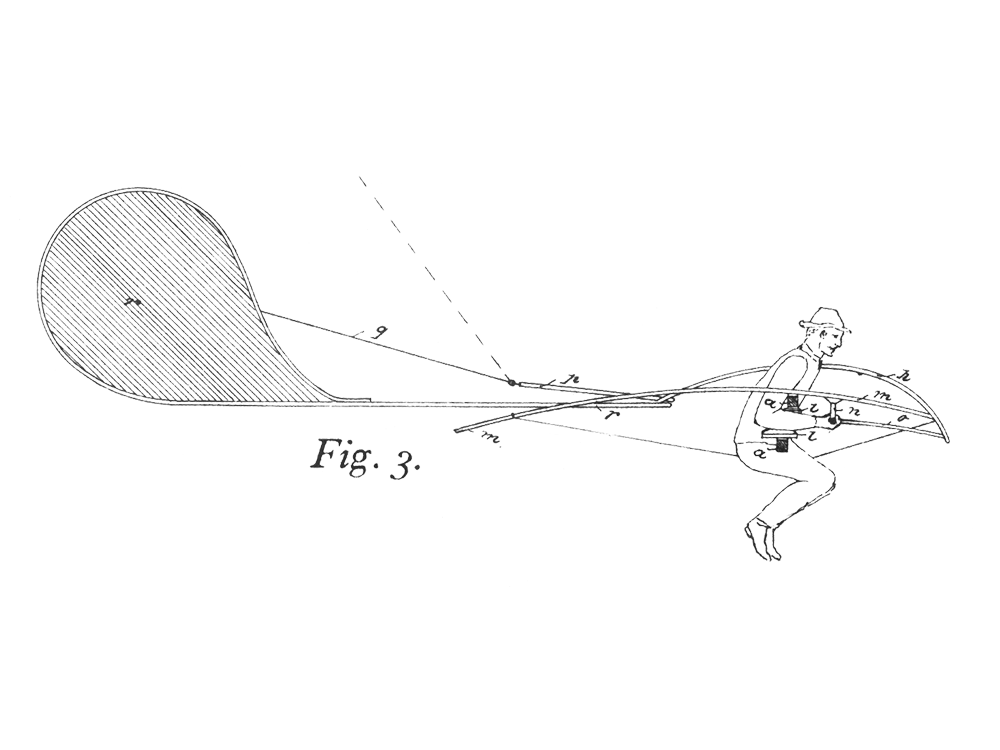

A result of his tests was the “Normal-Segelapparat” (DE77916A, DE84417A; see also flying machine US544816). This monoplane glider had a wing area of 13 square metres and a wingspan of 6.7 metres. It was produced at the “Maschinenfabrik Otto Lilienthal” and found buyers from all over the world. Thus it was the first serially produced aircraft.

A total of 21 different flying machines are attributed to Lilienthal. He undertook around 2,000 flight tests and spent altogether about five hours in the air. But then came 9 August 1896. On the Gollenberg hill in Stölln near Rhinow, he was caught by a thermal during his fourth flight of the day. He fell from a height of about 15 metres and died the next day.

“Of all the men who attacked the flying problem in the 19th century, Otto Lilienthal was easily the most important,” Wilbur Wright, pioneer of powered flight, wrote in 1912. “The world owes to him a great debt.”

BRIEFLY EXPLAINED: Second Patent Law Modernisation Act reform package Reform package strengthens Germany as a location for innovation

Online hearings, extension of time limits, new rules on public holidays: The Second Act to Simplify and Modernise Patent Law, which was adopted last year, brings about many changes for our customers. Some important changes are summarised below.

The last great reform of IP protection was made several years ago. To ensure the outstanding position of Germany as a location for IP protection in the field of industrial property in the future, the legislation adopted significant amendments in the Second Act to Simplify and Modernise Patent Law (2. Patentrechtsmodernisierungsgesetz).

Participation in IP procedures possible via video conferencing in the future

As an important element for procedures before the DPMA, the Second Patent Law Modernisation Act provides for the option to participate in proceedings and hearings and give evidence in IP procedures using image and sound transmission. This means that parties can participate in sessions via video conferencing in suitable cases at the discretion of the DPMA. In many cases, this saves costs and time and can accelerate the procedure. However, it is still possible to directly participate on site. “The coronavirus pandemic has once again clearly shown to us how important it is to have flexible and tailor-made solutions at the ready for our customers,” said the DPMA President and added: “By providing the option to participate in proceedings and hearings and give evidence online via video conferencing, we are expanding our e-government services in keeping with our mission statement as a digital service authority.”

Uniform rules on public holidays

The Second Patent Law Modernisation Act will also create uniform rules on public holidays. As the DPMA’s offices are in different federal German Länder, different public holidays are applicable there. In the future, all public holidays applicable at at least one of the DPMA’s offices will be recognised for the purpose of extending a time limit.

Extended time limit for PCT applications to enter the national phase

Another legislative amendment takes into account a long-standing request of the applicant community: The period for international applications (PCT applications) to enter the national phase at the DPMA as designated office or elected office will be extended from 30 to 31 months. “Experience has shown that many applicants make full use of the period for entry into the national phase,” said DPMA President Rudloff-Schäffer and added that a long period of decision-making was very important, especially in the PCT area, in order to assess the chances of success of a patent application entering the national phase, look for possible investors in order to market the invention, or prepare formal steps.

The three amendments mentioned above will enter into force on 1 May 2022. The DPMA will first establish the technical infrastructure necessary to participate in proceedings and hearings and give evidence via video conferencing.

In addition, as of 1 May 2022, the annual fees for supplementary protection certificates will be increased and trade mark law will be brought into line with the Madrid system for international trade mark protection.

The primary purpose of further amendments and new provisions in the IP laws that already entered into force on 18 August 2021 pursuant to Article 13 (1) of the Second Patent Law Modernisation Act is to simplify and clarify procedures.

Detailed information on the new provisions is available on our website.

In Focus: Provision of Asian patent literature Overcoming the language barrier with artificial intelligence

The search file of the DPMA includes more than 50 million patent documents from Asia, which potentially have to be taken into account for patent grants. The problem: So far, the content of the documents has been difficult to access because of the language barrier. This is now about to change.

The relevant prior art is essential for assessing the novelty and inventive step of an invention. The examining sections of the DPMA conduct prior art searches mainly in DEPATIS, the DPMA’s internal database, which comprises patent documents from all over the world. Of course, this also includes more than 50 million patent specifications from Asia, especially from China, Japan and Korea. This share precisely is growing, because currently two-thirds of all patent applications worldwide are filed in Asia. The problem is that the contents of these documents are not accessible or can only be accessed with difficulties, due to the language barrier. But how are our patent examiners supposed to conduct searches for these documents and take their contents into account when assessing whether an invention is patentable?

In order to solve this problem, we launched the measure “Access to Asian patent literature” in March 2021. As part of this measure, we first machine translate all available documents from China, Japan and South Korea into English and then add these translations to our internal DEPATIS database. This makes Asian patent documents accessible for a full-text search.

For the translation, we use “WIPO Translate” — a translation machine developed by the World Intellectual Property Organization (WIPO), which has been made available to the DPMA as part of its cooperation with WIPO. The core of WIPO Translate is an artificial neural network, which has been specially trained to translate patent literature.

Since March 2021, we have already machine translated more than 13 million Japanese documents, making them searchable in DEPATIS. This corresponds to half of our holdings of patent literature from Japan. In October 2021, we also started translating our holdings of more than 32 million Chinese documents. In 2022, we expect to start translating our holdings of more than six million Korean documents.

The Asian documents are translated at the DPMA’s computer centre, where WIPO Translate is running on our own servers. At present, we can translate an average of 90,000 documents per day. Probably, this will make it possible to translate the entire holdings of documents from China, Japan and Korea into English by 2023. Currently, WIPO Translate supports eleven languages. This opens up the possibility to also machine translate patent literature from other countries in the future and make it accessible for full-text searches.

Our “Access to Asian patent literature” measure will enable us, in the future, to use DEPATIS to conduct Asian prior art searches without restrictions, without having to resort to external databases. In this way, we create the conditions for more efficient patent searches while maintaining consistently high quality and, on this basis, increase the legal validity of the patents granted by the DPMA.